2 July 2025

Australian banks have today unveiled their latest scam fighting technology, with the launch of Confirmation of Payee – a new name-matching service designed to help protect customers from being tricked into sending money to criminals.

Banks have invested $100 million in this new technology which is a key initiative of the sector’s Scam-Safe Accord – a set of world-leading safeguards by banks to help keep the money of Australians safe.

Adrian Lovney, Chief Payments and Schemes Officer at Australian Payments Plus (AP+), which developed the service, said Confirmation of Payee helps reduce scams and mistaken payments by checking whether the name, BSB and account number entered by a customer match the account details held by the receiving bank and showing the match result before payment is made.

“Confirmation of Payee is all about giving customers greater control and confidence when making payments,” Mr Lovney said.

“It’s a simple concept, but it adds a powerful extra layer of protection for everyday transactions.”

Australian Banking Association CEO Anna Bligh said while Australia was one of the only countries in the world where scam losses were reducing, investing further in the latest scam fighting technology was crucial to driving losses down even further.

“This is critical new technology that will help protect a customer from transferring money straight into the hands of a scammer.”

“It is a new weapon that banks will have at their disposal to better shield customers from losing money to scams.

“When the rollout is complete, Australia will be one of only a handful of countries to have this technology in place across the entire banking sector, ensuring customers are protected regardless of who they bank with. It is further proof that Australian banks are leading the way when it comes to protecting customers from scams.”

Customer Owned Banking Association Chair Elizabeth Crouch AM said the new Confirmation of Payee service is a big leap forward in customer protection.

“Australia’s mutual banks are working hard to protect their customers’ money and the new Confirmation of Payee service is a big leap forward.”

“Developed as part of the banking sector’s Scam-Safe Accord, this crucial name-matching solution is being rolled out by all banks to deliver stronger safeguards against scams.”

“Customer-owned banks put their customers first and are committed to doing everything they can to deliver effective fraud and scam protections that work for their customers and communities.”

A national awareness campaign will also start today under the tag line “Check the name. Spot the scam.” to educate customers about this new technology.

How it works

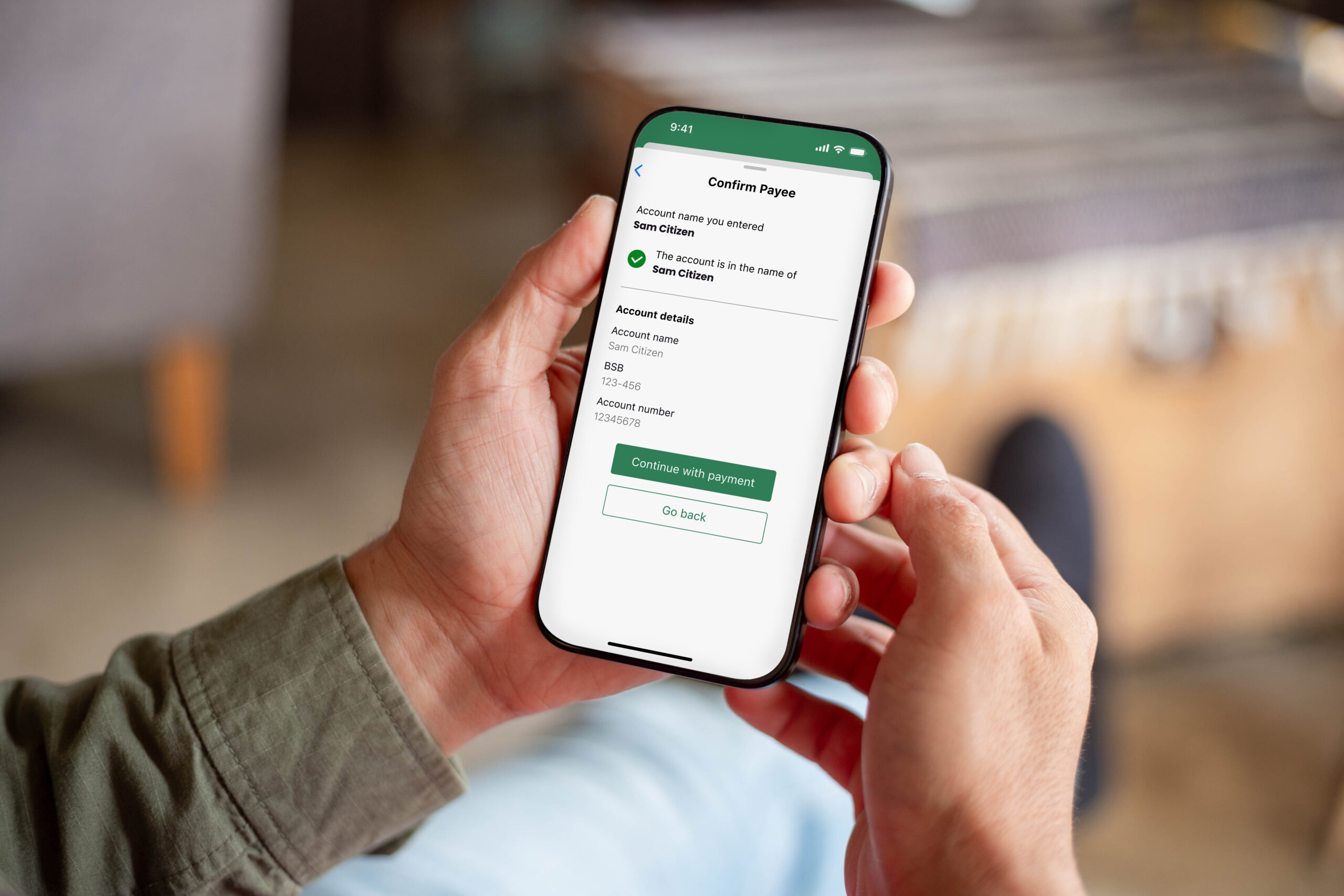

The new Confirmation of Payee service activates when a customer makes a first-time payment using a BSB and account number. After entering the account name and payment details, and before making a payment, a matching service checks whether the information matches the recipient’s bank data.

- If the details match, the account name will be displayed for confirmation.

- If there’s a close match (e.g. “John Smyth” instead of “John Smith”), the customer will see the account name and can confirm if it’s correct.

- For individual accounts with no match, the customer will be shown a warning and the account name won’t be shown to help protect privacy.

- For business and government accounts, the account name may still be shown.

Using that information, the customer can then decide if they want to go ahead and make the payment, pause and check the details again, or stop the payment altogether.

Latest news

Australians have now used Confirmation of Payee over 100 million times since the service was launched in July 2025, marking a major milestone in the banking industry’s efforts to protect consumers and businesses from scams and mistaken payments. Part of the banking sector’s Scam-Safe Accord, Confirmation of Payee adds another layer of protection by allowing… Read more »

Banks are urging Australians to side-step fake or dodgy tickets this footy season, as scammers set their sights on fans across all football codes. More than $36 million was lost to buying and selling scams last year, including fake ticket sales, with criminals looking to cash in on the excitement and passion of footy fans…. Read more »

E&OEPodcast InterviewThe Savings Tip Jar18 February 2026. Topics: Mortgage refinancing, savings accounts. Dominic Beattie (Host): Welcome to this week’s Dollar Dialog, and today we’re talking refinancing, with new data dropping from the ABS last week, showing that a record 640,000 Australian mortgages were refinanced through 2025, which is up 20% on the previous year. So,… Read more »