“The major banks now also all offer least-cost routing, with some making it the default offering for small and medium sized businesses. So there has been significant progress“

What is Least Cost Routing (LCR)?

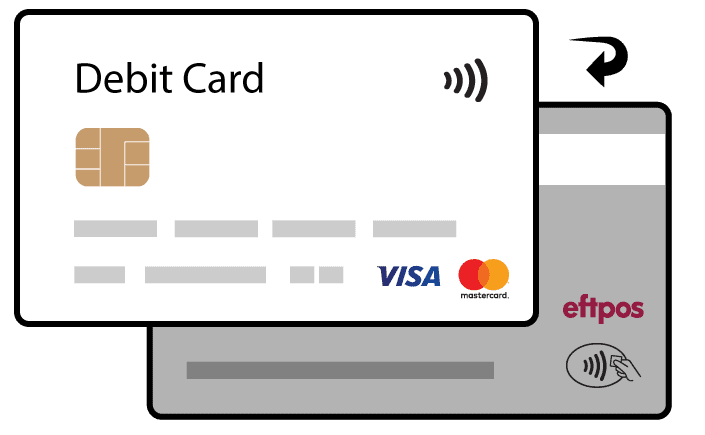

When a customer makes a contactless transaction with a merchant using a dual-network debit card, the payment can be routed via the least expensive option for the merchant via Mastercard, Visa or EFTPOS: this is Least Cost Routing (LCR).

LCR provides a choice for how merchant fees are charged when customers pay with a tap-and-go debit card.

- LCR applies to tap-and-go dual-network debit card transactions. This kind of debit card has a Visa or Mastercard logo on one side and an eftpos logo on the other.

- LCR is an opt-in feature that allows merchants to save on fees whenever a customer makes an eligible tap-and-go payment.

- It’s NOT applicable to tap-and-go credit card transactions, or debit card transactions made by inserting or swiping a debit card.

Merchant Choice Routing (MCR) is similar to Least Cost Routing (LCR)

Some banks use the term Merchant Choice Routing (MCR). This refers to the choice a merchant has to choose Least Cost Routing (LCR).

How does Least Cost Routing work?

Each payment network (Visa, Mastercard or eftpos) on a dual-network debit card charges different rates per transaction. When a merchant uses LCR, they can choose which network they send their contactless debit card payments through.

Merchants can opt to pay a flat fee payment or a percentage. They can calculate which format and network is best for their business, and by routing through the most cost-effective option, save on monthly merchant fees.

Savings on eligible transactions will vary for each business, depending on the merchant’s card mix, transaction volume, and amount per transaction, as well as their existing pricing plan.

More choice = more saving for small business

By opting in to LCR, and the choice of payment network and formats, a merchant may minimise costs.

95% of all eligible small business customers of Australia’s four major banks have had LCR made available or offered to them, and merchant awareness is rising.

LCR has increased competition amongst card schemes, reducing interchange fees and card payment fees. Mastercard and VISA debit charges have been dropping since 2013.

Is LCR always the best option?

The ABA advocates for merchants to be provided with choice for their payment options.

It’s important to understand, however, that LCR may not always result in savings. Some merchants in Australia may also seek the simplicity or certainty of a fixed price bundle (like a mobile phone plan) and therefore may choose not to adopt LCR for their business.

LCR can have different impacts on a business: case studies

Case study 1: Will’s book shop

Will owns a bookstore, with average transactions over $30.

If the LCR fee for a Visa/Mastercard debit transaction is 2%, and the eftpos transaction has a flat fee of $0.25, LCR may be the best option.

When LCR is not enabled, the average contactless purchase on a Visa/Mastercard debit card would cost Will’s business $0.60 (2% of $30).

If Will enabled LCR, the same transaction routed via eftpos would cost $0.25, saving $0.35 per transaction.

Case study 2: Jane’s coffee shop

Jane runs a local coffee shop, with most transactions under $10.

If the LCR fee for a Visa/Mastercard debit transaction is 2%, and if the eftpos transaction has a flat fee of $0.25, LCR might not be the best option.

When LCR is not enabled, the payment is automatically routed through the debit card. A $10 purchase would cost $0.20 (2% of $10).

If Jane enabled LCR, the same transaction via eftpos would cost $0.25, costing $0.05 per transaction.

Banks are there to help merchants understand their current fees and how enabling Least Cost Routing could benefit their business.

Find Your Bank: merchant services