2 May 2023

The RBA continues to address the nation’s inflation challenge with today’s 0.25% increase.

Last week’s inflation figures showed a 1.4% increase for the March quarter. This is a 7% increase in the past year which indicates the cost-of-living challenge faced by Australian households.

The ABA encourages those customers who are concerned about their financial situation to shop around to find the most suitable deal for their individual needs. Competition in the banking sector is strong and record levels of mortgage refinancing continues.

Banks strongly encourage any customers experiencing financial difficulty to reach out to access bank support services and to do so as early as possible. Bank support teams are also proactively communicating with those customers at risk.

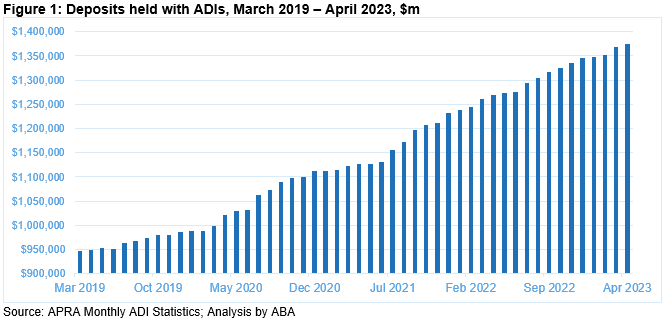

Australians have record levels of savings sitting in deposit and offset accounts while arrears remain at low levels. In April 2023 the value of household deposits on the books of ADIs grew for the 23rd month in a row, to $1.37 trillion.

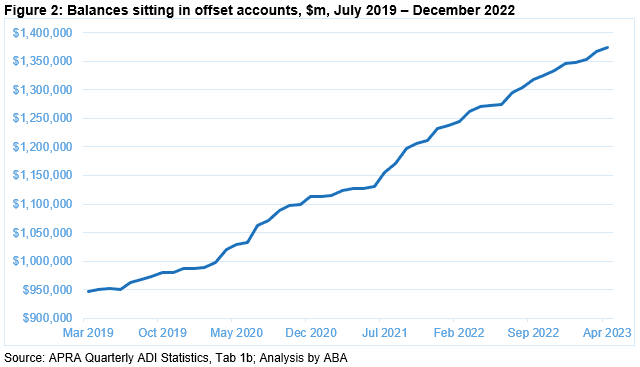

At $244b, there is now more sitting in mortgage offset accounts than ever before. In fact, there has been a growth of 42 per cent since December 2019 (Figure 2).

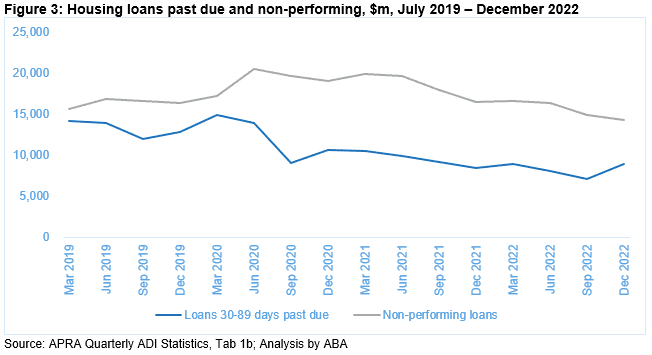

The value of non-performing loans (i.e. those 90+ days in arrears) fell in the last quarter of 2022, while loans 30-89 days past due has increased slightly, though remained below pre-COVID levels (Figure 3). The proportion of non-performing loans relative to the housing portfolio now sits at 0.59 per cent, down from 0.62 per cent in the September quarter and 0.79 per cent in December 2019.

Latest news

Australians have now used Confirmation of Payee over 100 million times since the service was launched in July 2025, marking a major milestone in the banking industry’s efforts to protect consumers and businesses from scams and mistaken payments. Part of the banking sector’s Scam-Safe Accord, Confirmation of Payee adds another layer of protection by allowing… Read more »

Banks are urging Australians to side-step fake or dodgy tickets this footy season, as scammers set their sights on fans across all football codes. More than $36 million was lost to buying and selling scams last year, including fake ticket sales, with criminals looking to cash in on the excitement and passion of footy fans…. Read more »

E&OEPodcast InterviewThe Savings Tip Jar18 February 2026. Topics: Mortgage refinancing, savings accounts. Dominic Beattie (Host): Welcome to this week’s Dollar Dialog, and today we’re talking refinancing, with new data dropping from the ABS last week, showing that a record 640,000 Australian mortgages were refinanced through 2025, which is up 20% on the previous year. So,… Read more »