6 June 2023

The RBA continues to address the nation’s inflation challenge with today’s 0.25% increase in the cash rate target, to 4.10%.

The latest inflation figures showed an increase to 6.8% in April, up from 6.3% the previous month, indicating the cost-of-living challenge faced by Australian households.

The ABA encourages those bank customers who are concerned about their financial situation to shop around to find the most suitable deal for their individual needs. Competition in the banking sector is strong and record levels of mortgage refinancing continues.

Banks strongly encourage any customers experiencing financial difficulty to reach out to access bank support services and to do so as early as possible.

Bank support teams are also proactively communicating with those customers at risk. Banks can assist customers by restructuring loans, offering interest only payments, extending the term of a loan and offering payment deferrals.

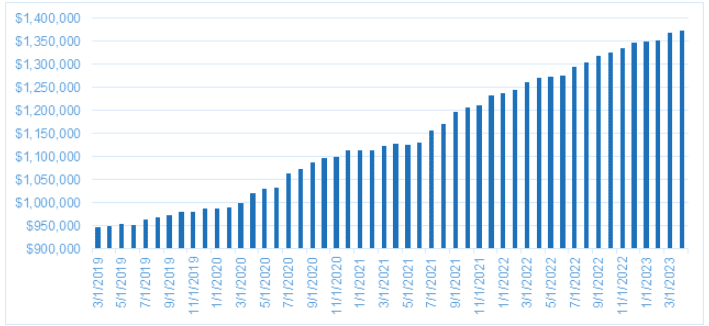

Australians have record levels of savings sitting in deposit and offset accounts while arrears remain at low levels. In April 2023 the value of household deposits on the books of ADIs grew for the 23rd month in a row, to $1.373 trillion.

Figure 1: Deposits held with ADIs, March 2019 – April 2023, $m

Latest news

E&OEPodcast InterviewThe Savings Tip Jar18 February 2026. Topics: Mortgage refinancing, savings accounts. Dominic Beattie (Host): Welcome to this week’s Dollar Dialog, and today we’re talking refinancing, with new data dropping from the ABS last week, showing that a record 640,000 Australian mortgages were refinanced through 2025, which is up 20% on the previous year. So,… Read more »

Over 640 000 homeowners refinanced their mortgage last year, according to new data released today by the Australian Bureau of Statistics. New lending indicators data shows 640 137 mortgages were refinanced throughout 2025, a 20 per cent jump from the previous year as more borrowers than ever before renegotiated or switched their home loans. ABA… Read more »

E&OERadio InterviewABC Radio Canberra9 February 2026. Topics: Romance scams; Scam Prevention Framework Emma Bickley (Host): You’re listening to afternoons on ABC Radio Canberra. I’m Emma Bickley, and my guest today is Simon Birmingham. He’s the CEO of the Australian Banking Association, and in the lead up to Valentine’s Day, they’re warning you that romance scams… Read more »